Are you unleashing the full potential of your data?

In this guest blog, Melissa Baez discusses why being intentional in using data matters for product development of inclusive financial services

-

Date

June 2019

-

Areas of expertiseResearch and Evidence (R&E) , Cross-cutting themes

-

CountriesSierra Leone , Tanzania, United Republic of , Zambia

-

KeywordsOffice of the Chief Economist , Research Management

-

ProjectData Management and Analytic Capability (DMAC) in sub-Saharan Africa

In today’s digital age, everyone knows we’re creating more data than ever before, but not everyone knows what to do with that data — including financial service providers (FSPs). With improved connectivity and increasing smartphone penetration, formerly anonymous and unserved market segments now have valuable ‘digital data’ identities. For customers, this data can lead to more relevant, affordable products that better address their needs, and for financial institutions, when used responsibly, it opens access to new market segments and can be used to deepen customer engagement. However, too many institutions lose out on this win-win opportunity due to information overload, inefficient processes, and legacy systems.

To address this data divide, Accion in partnership with Oxford Policy Management and Master Data Management (MDM), is implementing a new data-driven approach to product development through the Data Management and Analytics Capabilities (DMAC) project. Initiated by Financial Sector Deepening (FSD Africa) and International Development Research Center (IDRC), DMAC is a two-year program that uses data-driven evidence to help FSPs in sub-Saharan Africa to design inclusive and affordable products and services that respond to the needs of unserved and underserved adults, with a particular focus on women and youth. In this project, we are working closely with partner institutions to enhance their capabilities to manage and analyze data, develop and innovate new business models and reflect and share the lessons about what they have found works and what doesn’t. The program is operating across three different markets of varying digital maturity — Sierra Leone, Zambia, and Tanzania — and with three different types of FSPs: insurers, fintechs, and commercial banks.

What does it mean to take a data-driven approach to product development?

What makes the DMAC approach unique is being intentional — thinking about and taking deliberate actions — when using data in the product development process. Particularly as ‘big data’ is touted as a winning strategy for financial service providers, many institutions often collect data for data’s sake without a clear plan of why and how they intend to use it. Yet there are several publicly available external data sets like the Global Findex, census data, and telecom data which can provide important market insights to inform product design. For example, census data coupled with hospital incidence rates can provide insurers with a much more sophisticated and accurate picture of risk. This enables insurance companies to offer more competitive pricing—pricing that works within their target customers’ budgets, allowing them to reach a wider market.

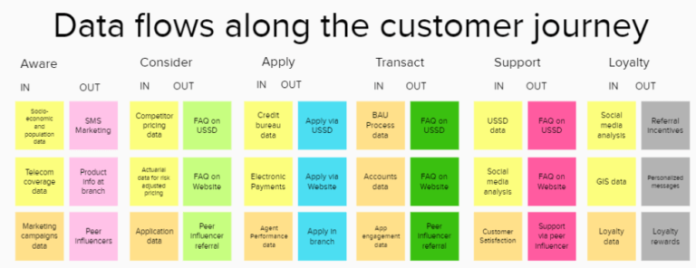

FSPs are often sitting on a wealth of internal data generated and captured through their operations and feedback provided by customers as they engage with products. To unleash the full potential of this data, we advise our partners to ‘look through the data lens’ at every step of the process. For example, in developing product concepts with our DMAC partners, we looked at the customer journey from a data perspective — mapping the inflows and outflows of data at each step. During this exercise, institutions identified areas where data collection and use could be improved. For one institution, this meant examining whether they were using data to ensure their radio marketing campaign was reaching their target customer segment — but they had no data collection in place for this campaign. They were missing out on the opportunity to better understand their customers and the effectiveness of their marketing.

This example illustrates one exercise where FSPs mapped the data inflows and outflows for each step in the customer journey.

For all, the mapping of data inflows and outflows led to several ‘aha moments’ as the institutions saw hundreds of data points that could be leveraged along the customer journey. While in some ways this was a bit overwhelming, there was an excitement about the magnitude of untapped possibilities. One institution realized their call center was a “data graveyard” of customer information, and another realized they were missing opportunities to connect with customers during critical moments in their lives — like marriage or having children — when they could build customer loyalty. For all institutions, having the systems and processes to enable the seamless flow of data was essential to creating an optimal customer experience.

With our partners, we emphasize that one data set or algorithm will not be the panacea to product success, nor will ‘big data,’ without a clear strategy of how to use it. Instead, they must be aware of all available data — public surveys, primary research, customer transactional data, call center logs, etc. — and they must be strategic in how they mine, analyze, and apply information to create a winning value proposition for the customer. It’s like building a new habit — by being intentional with data in the product development process, financial service providers can transform how they develop products and serve customers, supporting a more sustainable business model and driving a social impact.

This article originally appeared in Accion.